Market Overview

The Northwest Indiana region consists of Lake, Porter, and LaPorte Counties and is known for being Indiana’s second largest economy made up of urban, suburban and rural communities representing a $35 billion economy.

Lake and Porter Counties’ largest economic drivers are the steel and manufacturing industries. Lake County is a large supplier of steel for appliances, cars, as well as many other products, and contributes $18.2 billion of economic output annually.

In recent years, casinos have also contributed greatly to the area as there are four major

casinos along Lake Michigan, specifically in Lake and La Porte Counties. A few more notable industries in the area are healthcare, manufacturing, and retail. Major employers of Northwest Indiana are US Steel Corporation, Cleveland-Cliff Inc., Blue Chip Casino, Franciscan Health, IU Health, Community Hospital, NIPSCO, and the new Hardrock Casino in Gary.¹ As the healthcare sector continues growing in the region, there are multiple new hospitals and facilities under construction and planned for the next few years.

The Northwest Indiana region has long been known as a hub for manufacturing which

propelled Indiana into becoming the leading supplier of steel in the United States since 1977. However, as technology transforms the tasks once done by human workers to robots and automation, the region has been working to diversify their economy and transform former industrial sites to new uses. The $40 million Digital Crossroads of America Data Center on the site of the former State Line Generating Plant in Hammond opened Phase I in 2019. The 77-acre site includes a 105,000 square-foot data center, tech incubator, renewable energy generation, and a greenhouse. The new data center project on the site could expand in phases to include 400,000 more square-feet and $200 million in total investment, which would make it one of the largest data centers in the country.

Northwest Indiana continues to benefit from its business-friendly environment and proximity to the Chicago metro. The region ranks second in gross domestic product among metropolitan areas in the state, only behind Indianapolis, and is ranked 89th overall nationally. Lake County ranks second out of 92 Indiana counties in total population and is ranked seventh best county in the state for Young Professionals in Indiana.²

Northwest Indiana is often referred to as a “bedroom community” for nearby Chicago –

offering a lower cost of living and slower suburban pace of life, with the proximity to the city to commute to work. As residents are continually relocating to the area and the region continues to see growth in new companies, several cities and towns have begun investing heavily in key areas to transform their communities.

To assist with the growth occurring in Northwest Indiana, transportation developments are

underway. The South Shore’s $933 million West Lake Corridor project is expected to reach

high-growth areas in Lake County, as well as create a faster, less expensive, and more reliable form of transportation to the Chicago market and surrounding areas.

Population

787,057

Households

302,089

Median Household Income

$59,622

Education

37% Highschool

30% Some College

24% Bach/Grad+

Total Businesses

25,614

Total Employees

316,024

Source: Esri 2021

1. http://www.hoosierdata.in.gov/major_employers.asp?areaID=089

1. https://www.niche.com/places-to-live/c/lake-county-in/rankings/

Industrial OVerview

MERRILLVILLE HAS BECOME GROUND ZERO FOR INDUSTRIAL DEVELPMENT IN THE REGION

Industrial demand in the region continues unabated. The vacancy rate for Class A industrial was just 1.7% at the end of Q4. Vacancy in Class A has been falling since 2019 and reached its lowest vacancy in 10 years in 2020 at 0.9%. There may be an uptick in vacancy in 2022 when nearly 1 million square feet of space under construction is completed, although the spaces will likely fill quickly. Market rents have steadily climbed and were $6.81 per square-foot in Q4. All other classes combined had slightly higher vacancy at 7.3% with market rents of $6.44. Net absorption was positive with 970,963 square feet, the highest net absorption in ten years. There are a number of new projects that were announced in Q4 that will bring much needed space to the market. All classes are finding users and buyers in the market. Class A is attracting large companies that are well-funded, while the smaller and older industrial sites are attracting new businesses into the region from neighboring states as well as newly formed companies just starting out.

- Dayton Street Partners is planning a 42-acre, 538,000 square-foot project in Portage on land they recently purchased.² The project is called DSP Crossroads Portage and will include three spec buildings that will front I-94 and is west of Willowcreek Road. The site will be close to the Crisman Road interchange. Sales prices were not disclosed for all parcels, but a 10-acre parcel sold for $1,350,000.

- Speedwagon Capital Partners has purchased a long vacant bar mill in East Chicago from Cleveland-Cliffs Indiana Harbor. The company plans to redevelop the 88-acre site at Cline Avenue and Dickey Road. The property is well-located near Lake Michigan with rail and barge access and is just 25 minutes from Chicago.³

- The Missner Group is planning more development in the Ameriplex at the Crossroads in Merrillville. The company already owns a 26-acre parcel and is in the process of purchasing two more adjacent parcels that will in total have approximately 82-acres for development. A zoning change is required to start the project that will be developed in phases and contain approximately 1 million square feet.⁴

- Another planned development in Merrillville is even larger. Crow Holdings has been acquiring land across I-65 from Ameriplex; from 93rd Avenue to 101st along Mississippi Street. The 196-acres is proposed for 2.3 million square feet of development with possibly five buildings built in the next 4-5 years. Crow Holdings has also constructed several buildings in Ameriplex.⁵

The Northwestern Indiana Regional Planning Commission recently conducted a study that examined e-commerce and its impact on development in Northwest Indiana. Northwest Indiana is well-positioned to become an e-commerce hub with its proximity to rail, air freight, ports, and interstates. The study came up with suggestions to increase development in the future, such as job training, infrastructure changes, and redevelopment.⁶

TRENDS

-

There is high demand for all classes and sizes of industrial in the region. Supply will continue to lag demand.

-

Class A vacancy will remain low, despite deliveries of new spec buildings throughout 2022. Property will continue to lease up quickly.

-

While sizable acres for development get harder to come by, older industrial properties present an option for redevelopment.

-

Merrillville has been a hot spot for industrial development that will likely continue for the next several years. Developers are buying up land, particularly near I-65 and U.S. Highway 30.

NORTHWEST INDIANA INDUSTRIAL SALES VOLUME ($)

Source: CoStar

NORTHWEST INDIANA INDUSTRIAL BUYER COMPOSITION

Source: CoStar

NORTHWEST INDIANA CONSTRUCTION COMPLETIONS ($)

Source: CoStar

Office Overview

MEDICAL OFFICE AND CLASS A HAS CONTINUED DEMAND IN NORTHWEST INDIANA BY USERS AND BUYERS

Class A office is still a strong performer in Northwest Indiana. Class A vacancy rates were at their lowest in ten years in Q3 at 2.6%. They rose slightly in the final quarter of 2021 to end at 3.7%. Vacancy is projected to fall slightly again and remain flat through 2022. Market rents were steady in 2021 hovering around $27 per square-foot. Net absorption was negative 14,000 square feet but should be positive in Q1 2022. The vacancy rate for all other classes combined was 6.3% in Q4, down from 7% in Q3. Market Rents haven’t fluctuated much since Q4 2020 and are still at $19.23. Net absorption was the second highest in ten years at 113,120 in Q4.¹

There were a few office sales in the region. Gridhawk purchased a 20,392 square-foot building at 9980 Georgia Street in Crown Point for $2.9 million. In Merrillville, a 19,990 square-foot building at 8488 Georgia Street sold in November for $6 million.³ Bradley Company assisted a client with a sale of a 12,000 square-foot office building in Schererville at 20 East U.S. Highway 30.

Some office projects under construction:

- A 53,546 square-foot two story office at 1501 E Glendale Boulevard in Valparaiso, with a delivery date of May 2022.

- A 4-story building is under construction at Maple Leaf Crossing at Calumet and 45th Avenue. The multi-tenant building will be 15,000 square feet.

- ValpoPartners has a build-to-suit office building under construction at 255-257 Indiana Avenue in Valparaiso.

Medical investment continues in the region with new projects announced, underway or opened in Q4.

- UChicago’s announced in October that they’re planning

a 116,000-square-foot micro hospital at 109th Avenue and Interstate 65 in Crown Point that would provide specialty care in areas including cancer, cardiology, digestive diseases, neurology and neurosurgery, orthopedics, pediatrics, transplant medicine and women’s health.⁴ The Merrillville / Crown Point medical corridor contains nearly 1.7 million square feet of medical office space that will increase to 2.3 million with UChicago’s facility and the new Franciscan hospital that is currently under construction.² - Northwest Health broke ground in December on a new 9,372 square-foot medical office in LaPorte County at 6923 West 400 North in Michigan City.⁵

- Methodist Hospital opened a new urgent care center in Valparaiso at 1781 W. Morthland Drive.

NiSource announced that they are looking for a new HQ in the region in 2022. NiSource is one of Indiana’s largest utilities and employs over 8,000 people and is one of Northwest Indiana’s largest employers. Their current building is 315,582 square feet on 43.5 acres at 801 E. 86th Avenue in Merrillville. The current building was built in 1978. The company is seeking to modernize their HQ environment and will likely sell their current property which could be redeveloped.⁶

TRENDS

- The office sector seems to have finally started to stabilize after nearly two years of the pandemic-related challenges. However, return to office versus remote work will continue to factor into companies decisions on office space.

- Look for more office development, especially in Munster, Merrillville, and Crown Point.

- Class B properties will struggle the most since buyers are interested in older properties they can renovate and increase rents or sale prices in the future with a higher profit margin.

-

CoStar

-

RevistaMed/Reonomy

-

Reonomy

NORTHWEST INDIANA OFFICE SALES VOLUME

Source: CoStar

NORTHWEST INDIANA OFFICE SALES BUYER COMPOSITION

Source: CoStar

NORTHWEST INDIANA OFFICE SALES PSF ($)

Source: CoStar

Retail Overview

RETAIL IS FLOUISHING IN THE REGION WITH EVEN OLDER MARKET SPACES FILLING UP AS DEMAND REMAINS STRONG

Class A retail vacancy end Q4 at 3.5% and is expected to stay at this level through 2022. Absorption was positive with 12,000 square feet absorbed. Market rents have been steadily increasing since Q3 2020 and ended at $15.55 in Q4. Class B had positive net absorption from Q3 2020, with only Q2 2021 with negative absorption. There was over 83,000 square feet absorbed in Q4. Market rents are rising and are approximately $19.24 with vacancy at 6%. Class C rents range between $9-$12 and vacancy is 3.9% with slightly negative net absorption of 1,600 square feet.

Two commuter rail projects will bring future growth to the region. The South Shore Double Track project will open in early 2024 and the West Lake Corridor line that will open in 2025. Project work has already begun for both projects. Updates to current stations will be made and new stations added for the West Lake Corridor. The stations are expected to bring new developments into the area. The corridor will run 8.5 miles from Hammond to Munster and Dyer. The Double Track project will create a double track from Michigan City through Gary. The Double Track project is expected to be complete in early 2024. Both projects will begin construction this spring.

Hammond has proposed a development district around the future Hammond Gateway commuter railroad station. The city is looking at mixed-use buildings with ground floor retail and office and or apartments above. Two derelict buildings

in downtown are scheduled for demolition as part of their larger downtown revitalization plan with 350 residential units planned and $5 million awarded from the Indiana Economic Development Corp. to redevelop the Bank Calumet building.

Michigan City has solicited plans from developers for a mixed-use development on a downtown city block around the South Shore Line’s 11th Street Station. The project would include restoring the facade of the train station, along with building out and operating 426 commuter parking spaces. The developer chosen will also have access to $16 million in funds for the project. The city wants the project complete by the end of 2024 when the South Shore Line is opened.²

Valparaiso is also making major investments in their downtown. The city recently released their “Elevate Valpo” plan as a guide for future downtown investments by creating maps with designated districts for targeted future development.² A new mixed-use development, named The Linc will be comprised of three, four-story buildings that will include a total of 121 apartments, as well as ground floor retail and restaurant space a 300-space parking structure. Construction will begin in late 2022.³ Valparaiso University has also announced a “Vitalize Valpo” plan for 130 acres it has acquired near the campus. Details haven’t been completed yet, but the development could have a major impact on the city.⁴

Trends

- Vacancy is likely to continue to decline through next quarter as demand remains strong, especially in Munster, Schererville, Dyer, Crown Point, and St. John.

- Smaller retail spaces have become scarce in Schereville, which could lead to more future development.

- High visibility mixed-use projects are filling up with office, retail, and medical users.

- While malls have become less desirable for tenants within, outlots surrounding them remain in demand, due to their high visibility. Restaurants and other retailers that closed will likely see more demolitions to make way for new users.

- Supply chain difficulties, labor shortages, and inflation could impact the retail sector’s momentum in 2022.

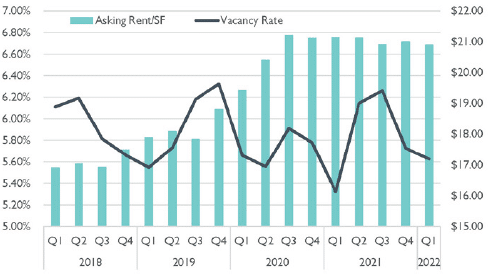

NORTHWEST INDIANA ASKING RENT & VACANCY

Source: CoStar

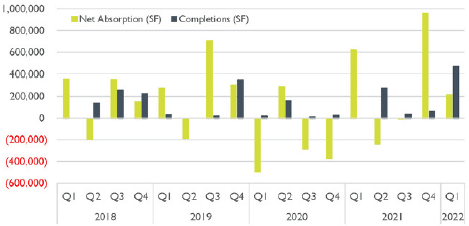

NORTHWEST INDIANA ABSORPTION TRENDS

Source: CoStar

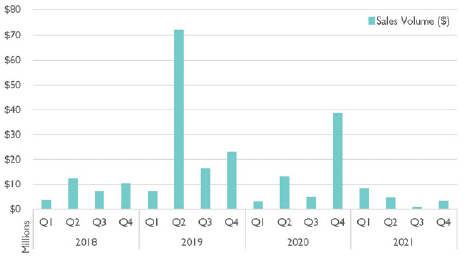

NORTHWEST INDIANA SALES TRANSACTION VOLUME ($)

Source: CoStar